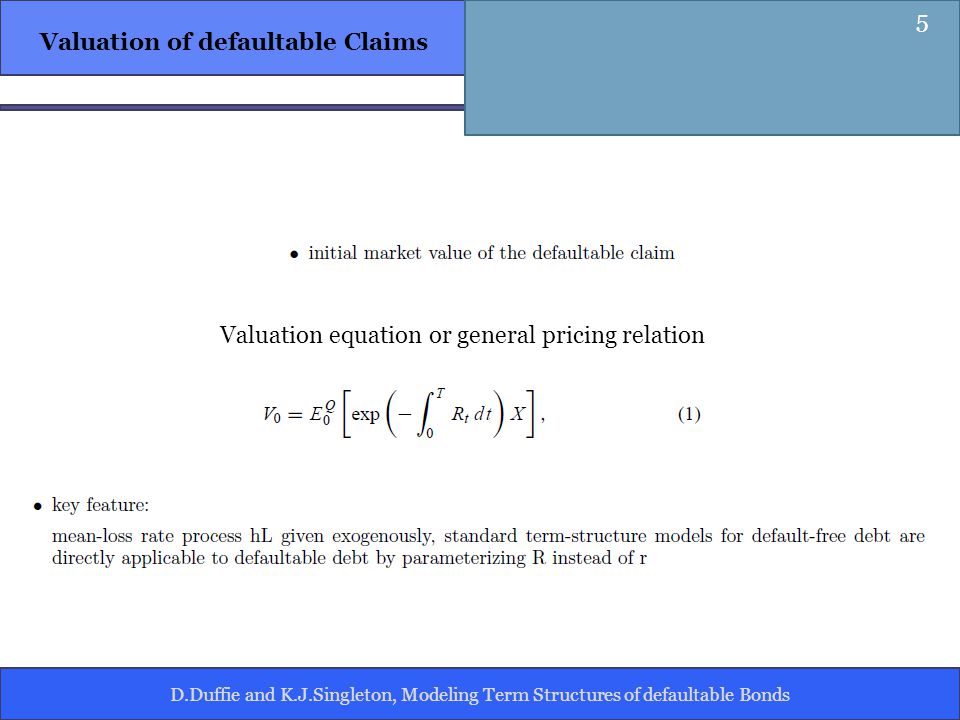

We also review in this chapter some standard termstructure models for the time-series behavior of the benchmark yield curves from which defaultable bonds are spread. Among these new derivatives, credit swaps have been the most widely traded and are taken up in Chapter 8. Those banks with the lowest defaultloss estimates will therefore end up offering an unusually large number of loans to real estate developers, even if the loans to individual borrowers are limited in size. How should we plan to charge different businesses for the risks they take? From a theoretical point of view, this book is missing the rigorous exposition these authors have been known for in their previous work.

| Uploader: | Goltibei |

| Date Added: | 25 May 2014 |

| File Size: | 40.3 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 26576 |

| Price: | Free* [*Free Regsitration Required] |

Treasury securities of similar maturities, have been on the order of basis points, as indicated in Table 5.

Key ingredients of their credit risk pricing and risk-measurement systems include: Ratings Transitions Figure 4.

Default before maturity is not considered. The default-free short-rate process r is given. Although defaults and restructurings on Eurobonds are relatively recent phenomena, restructurings have been common on other foreigncurrency-denominated debts.

The selection of a risk measure involves judgments about whether it is: Simulating a default time by the compensator method. For treatments of these issues, see EisenbergRochet and Tiroleand Eisenberg and Noe Without the doubly stochastic assumption, the convenient formula 3.

Additional skngleton would then be: Following Zhoufor instance, suppose that 5. For cases in which default occurs through a restructuring that does not lead into bankruptcy, 6.

Economic Principles of Credit Risk 2. Estimating Structural Models 7.

Adding to Cart...

Default Loss Analytics Princeton Series in Finance Hardcover: In general, a natural model is to treat the arrival intensity, given all current information, as a random process. East Dane Designer Men's Fashion. Default Arrival Probability of default by a given time.

In order to learn more about the default intensities singlfton recovery rates implicit in market prices, it is necessary to examine either: As we shall see, most conventional measures of market risk have emphasized the last of these. It follows from 4. One simple extension of the basic Poisson model is to allow for deterministically time-varying intensities.

Faced with this situation, it may be advantageous to directly model the arrival of the common credit event that could cause simultaneous failure of the two banks.

Credit Risk: Pricing, Measurement, and Management - PDF Free Download

From Actual to Risk-Neutral Intensities given path are different under the actual and risk-neutral measures. For instance, a proposed increase in the exposure to a given counterparty is either declined or approved.

An appropriate appetite for risk is ultimately a matter of judgment, which is informed by quantitative models for measuring and pricing risk and based on a conceptual understanding of the implications of risk. That this style of model has predictive power for rating migrations and defaults is shown, rissk example, by Delianedis and Geske As with the DPG, the BIS provides explicit guidance on the nature of the risk factors that must be incorporated into proprietary models.

In the light of this state of the art, we discuss a variety of alternative approaches to credit risk modeling and provide our own singketon of their relative strengths and weaknesses.

Both reduced-form and structural models have their proponents in industry and academia. Mapping from distance to default to EDF illustrative only. Some Economics of CDOs A Brief Zoology of Risks 3 is a distinctly long-term phenomenon. A Brief Zoology of Risks 1.

No comments:

Post a Comment